Shark is our top quant trading bot, generating BTC and ETH profits through options arbitrage.

It's especially effective in today's volatile market with high expectations for crypto price growth.

Accelerate Your Bitcoin Accumulation with

Shark

Shark is our top quant trading bot, generating BTC and ETH profits through options arbitrage.

It's especially effective in today's volatile market with high expectations for crypto price growth.

Return since inception

218.86%

1 month return

8.44%

3 months return

26.77%

If you invest 1 BTC into Shark, your Bitcoin holdings will

increase by 8.44% every month,

doubling in 8.5 months.

You will then have 2 BTC

Calculate it in detail yourself!

My investment amount

1 BTC

My target amount

1.5 BTC

If you invest 1 BTC into Shark,

your Bitcoin holdings will increase by

0.5 BTC

in 5 months.

You will then have 1.5 BTC

How calculated?

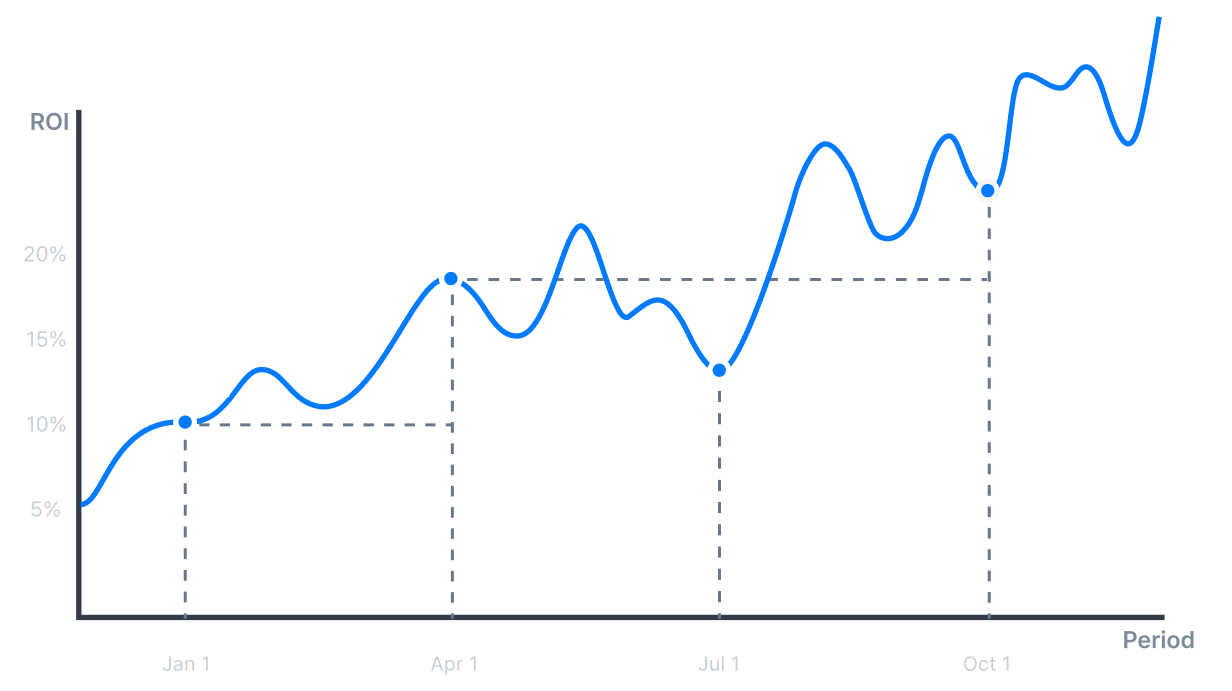

Based on Shark’s past returns, the period returns were calculated as follows.

Period

1 month

3 months

1 year

ROI

8.44%

26.77%

145.61%

You can get all these exclusive benefits by simply signing up to SmashFi now.

No additional requirements!

Minimum investment

Start with any amount that feels right for you.

Transfer fees

Deposits and withdrawals on Binance have no network fee because they are off-chain transfers.

Management fees

Enjoy the full value of your investment

without deductions.

Performance fee

Benefit from our services at a reduced rate,

down from 30% to 25%.

A option statistical arbitrage strategy that takes advantage of disparities between implied volatility and statistical volatility. This strategy opportunistically buys synthetic positions when implied volatility is statistically lower and sells them when it's higher. This strategy generates profits by estimating the theoretical prices of various synthetic positions and betting that the gap between these theoretical prices and market prices will narrow. However, it's important to note that this strategy may result in losses if the gap between theoretical and market prices unexpectedly widens or if the associated Greeks are unfavorable.

Management Fee

Promotion

2% → 0%

Performance Fee

Promotion

30% → 25%

FAQ

When and how are fees charged?

Fees are billed at the end of each quarter and are deducted from the fund NAV. The management fee is charged at the rate of the fee * fund subscription period for the quarter / 365, and the performance fee is charged at the rate of the fee * High Watermark Return.

When can I redeem?

You can apply for a redemption at any time. Please note that redemptions may take 1-3 business days to process and may incur a redemption fee depending on the product. However, there are currently no redemption fees during the initial promotional period.

What is High-Water Mark Performance fee?

A high water mark performance fee is a compensation structure used in investment funds, such as hedge funds. It establishes a benchmark representing the fund's highest value since inception or the last fee was charged. Managers can only collect performance fees when they generate returns that surpass this benchmark, aligning their interests with those of investors and encouraging responsible investment management.

Is the return of the product based on the number of coins or on the dollar value?

SmashFi calculates returns based on the quantity of specific coins, not their dollar value. This coin-based returns approach means that the performance of each product is measured by the change in the number of coins held, rather than their monetary value.